The idea of centralization refers to the use of a single entity that controls transactions. Buyers and sellers alike trust this entity to handle their assets. This is common in a bank setup, where a customer trusts the bank to hold his or her money.

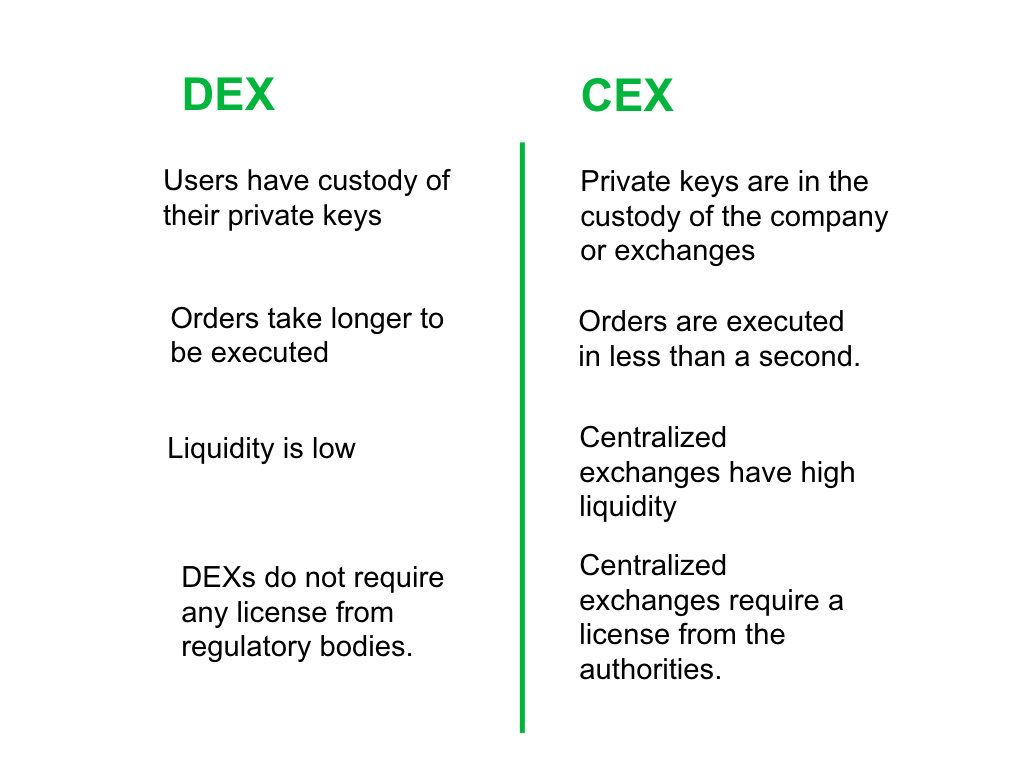

Centralized exchanges are no different, they can be used to conduct trades from fiat to cryptocurrency (or vice versa), while decentralized exchanges are an alternative; they cut out the middle man, generating what is often thought of as a “trustless” environment. These types of exchanges function as peer-to-peer exchanges. Transactions are executed autonomously based on pre-agreed rules. This is accomplished, at a techbnical level using smart contracts or atomic swaps.

An example of a CEX is Binance, Gate.io, and an example of a DEX is Sovryn, Liquality Swap, AtomicDEX, Blindex.

Pros and Cons of DEXes

Pros

Decentralized exchanges provide more security since there is no one entity that can be hacked, whereas a centralized exchange is more vulnerable to exploits because of its centralized nature, which in turn could affect its users.

A DEX provides sovereignty in that users retain access to their wallets and hence retain control of their own crypto holdings.

Cons

The aspect of DEXes being more secure due to decentralization cuts both ways. Any transactions that are executed are irreversible, as blockchain transactions are immutable. If transactions are made in genuine error, there is not authority figure that can “reset” or “undo” the mistake.

DEXes require users to manage their own wallet software. This is very difficult and too technical for many users, often resulting in poor user experience.

Next

Be sure to check out our next article in this guide, about The Features of a DEX

If you would like to delve deeper, here are some resources and tools that we recommend.

Resources: