In this section, we will cover the difference between a stablecoin and other digital assets like bitcoins, fiat currency, fungible tokens, Central Bank Digital Currency (CBDCs), and Altcoins.

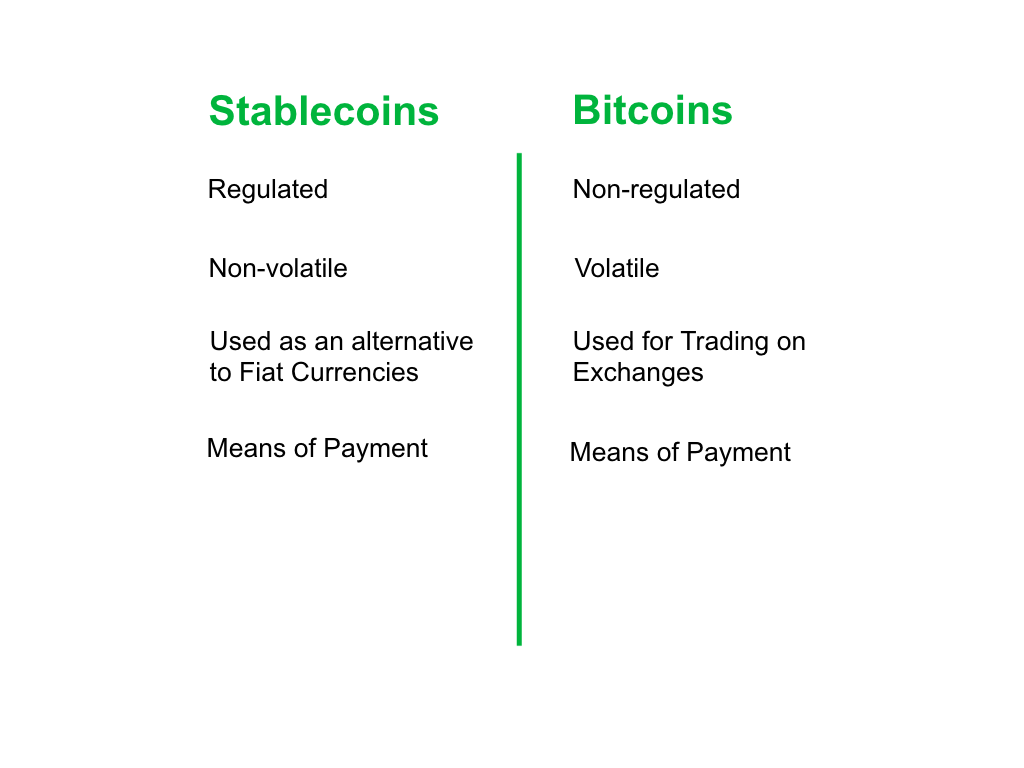

Stablecoin vs Bitcoins

A stablecoin is a token that has a non-volatile price and Bitcoin is a cryptocurrency whose price is volatile in nature. Stablecoins are used to minimize the price volatility of cryptocurrencies like Bitcoins.

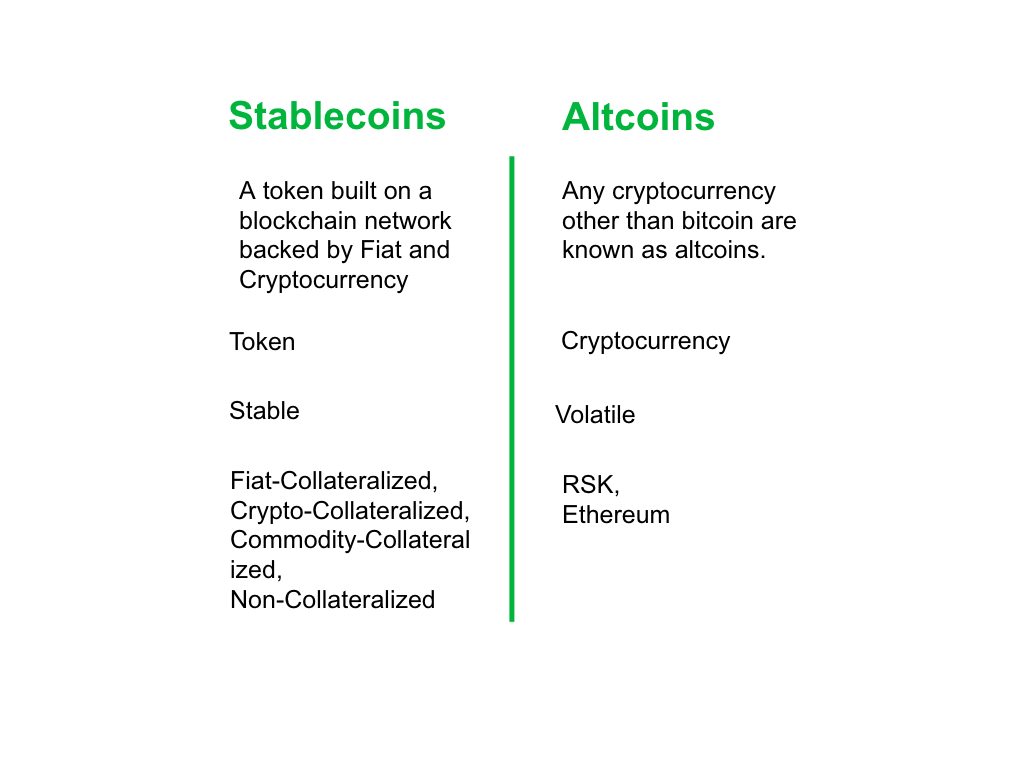

Stablecoin vs Altcoin

Altcoins are cryptocurrencies other than Bitcoin. Similar comparisons apply, with regards to volatility.

Stablecoin vs Fiat

Stablecoins are issued by crypto companies that are backed by traditional financial investment tools. They can be pegged to any fiat currency, foreign exchange-traded commodities, precious or industrial metals.

While fiat currencies are issued by central banks, they are not asset-backed. Their value depends on the central bank. The central bank can regulate the total supply in circulation by printing and withdrawing them from use.

Stablecoin vs Fungible Tokens

A stablecoin is a type of fungible token whose value is fixed to another asset, often currencies such as the US dollar or the Euro, and other assets.

Read: Cryptocurrency vs Token or watch the explainer video below:

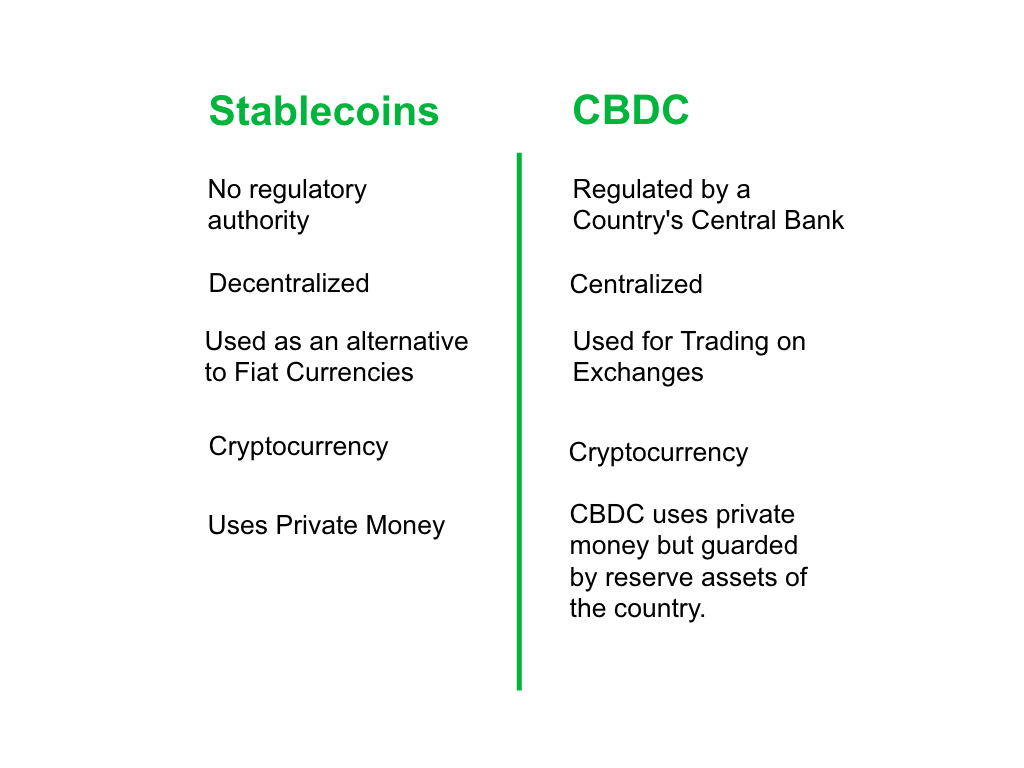

Stablecoin vs CBDCs

A stablecoin may or may not be regulated, while Central Bank Digital Currency (CBDC) is completely regulated by the monetary authorities of a nation. This means stablecoins are decentralized while CBDCs are centralized. Furthermore, CBDCs may be implemented with fungible tokens, in a manner similar to stablecoins, or they may be implemented using other technologies, including centralized ones.

Stablecoin Gas fee Comparison tool

This is a tool for comparing average gas fees paid for the last 200 transfer transactions of DAI and USDT Stablecoins on Ethereum and RSK blockchains. The tool makes a live request to the Covalent database, gets the information about the latest transactions of selected Stablecoin and displays the prices converted to USD using the latest rBTC – USD and Ether – USD exchange rate.

Stablecoin Gas Fee Comparison Tool (Discontinued)

If you would like to delve deeper, here are some resources and tools that we recommend.

Resources: